About the Project

All oil and gas projects have associated cleanup costs—environmental debts owed by law to the public in exchange for the license to drill—but the industry's reported numbers are underestimated to pennies on the dollar. This accounting misrepresentation makes companies appear healthy, allowing them to continue borrowing money, drilling wells and creating additional hidden liabilities in the process.

We’re eager to see oil and gas replaced with renewables, but as the transition accelerates, what will happen when companies or even the entire industry crashes? Someone is going to pay for cleanup, and without rapid corrective action, the lion’s share of these costs will fall on taxpayers and investors.

True Costs leverages existing legal and financial frameworks to ensure that the costs of doing business are borne by the profiting companies, rather than investors and the public.

Asset Retirement Obligation /ˈaset rəˈtī(ə)rmənt ˌäbləˈɡāSH(ə)n/

definition 1:

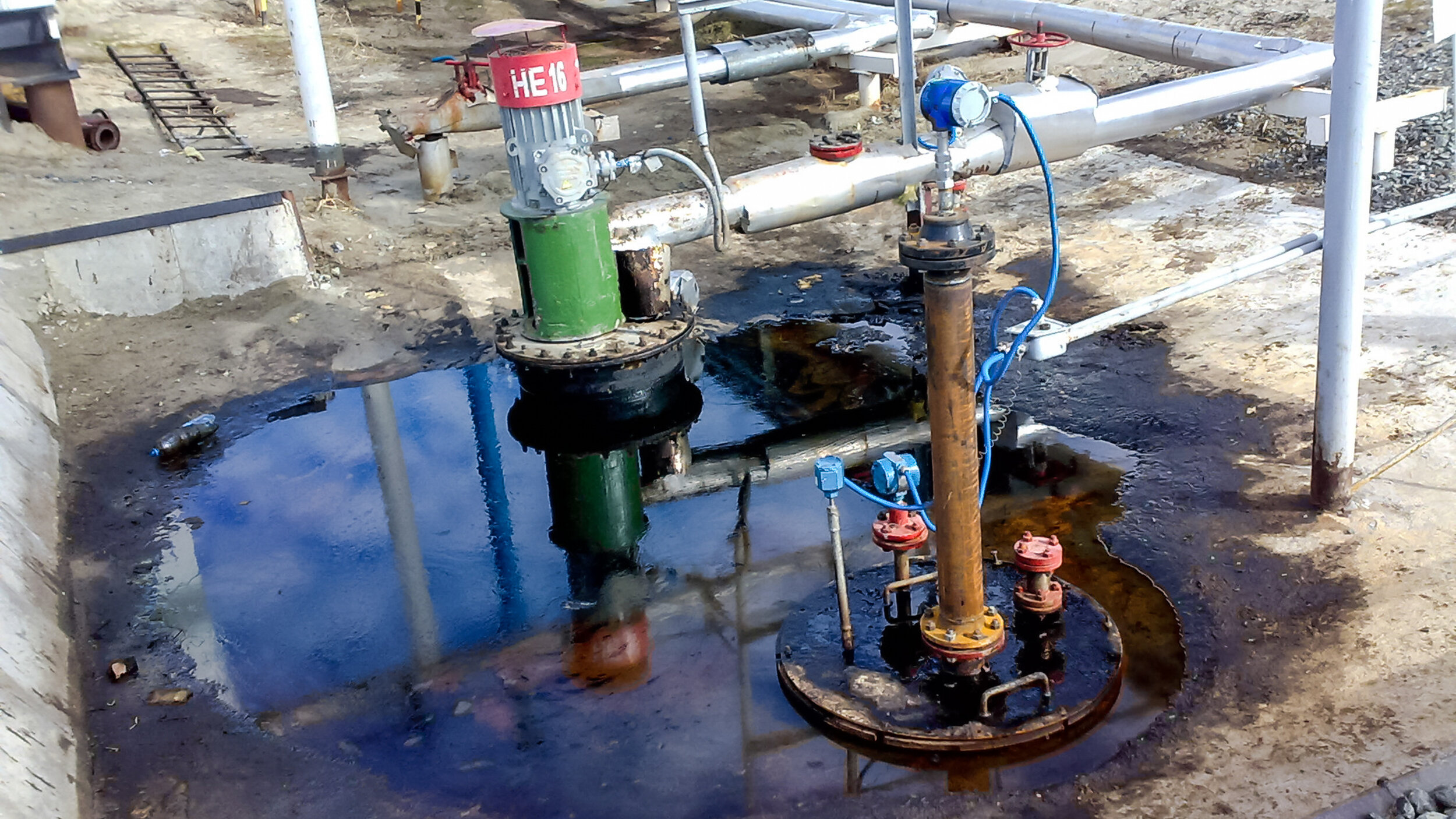

A legal obligation to plug and decommission wells and associated infrastructure after production has ceased, including routine site remediation and restoration of the land or sea to its approximate state prior to extraction.

IN OTHER WORDS:

When oil and gas are no longer flowing, the companies who profited from extraction are required by law to plug the holes and restore the landscape.

definition 2:

The accounting provision reported in audited financial statements intended to represent the cost of fulfilling the legal requirements of the asset retirement obligation.

IN OTHER WORDS:

The estimated cost to clean up after extraction ends, reported as a liability on corporate balance sheets. In practice, this number is underestimated and heavily discounted, artificially depressing corporate decommissioning liabilities.

The average cost to plug and reclaim a single abandoned well is estimated to be up to $150,000.

3.2 million abandoned oil and gas wells exist in the United States.

Social & Environmental Impacts

The North American oil and gas industry cannot possibly pay to cleanup the mess they’ve profited from creating. This reality poses enormous risks to the financial and environmental future of our world.

Orphaned oil and gas wells are a threat to our local farmlands, communities and wilderness areas. They have the potential to leak toxic materials into the soil, water supply and air. These liabilities are also a major source of leaking methane, an incredibly flammable and potent greenhouse gas.

Reducing emissions from oilfields is one of the most effective ways to confront climate change. Better yet, keeping oil and gas in the ground would eliminate potential emissions and pollution from these projects altogether.

True Costs works to expose the oil and gas companies that line their own pockets before escaping into bankruptcy and leaving their mess for the public to clean up. Let’s protect the financial and environmental health of all communities by ensuring there’s a plan to safely retire each and every well.

When the Wells Run Dry

Magnifying the Localized Impacts

Our environmental journalist took second place at the Society for Environmental Journalists (“SEJ”) 20th Annual Awards for Reporting on the Environment.

Check out the stories:

"This collaborative investigation produced by the Center for Public Integrity and the Los Angeles Times revealed that the 35,000 dry oil wells across California require a massive cleanup that state and federal governments are not prepared to clean up even as the wells continue to spew dangerous fumes throughout adjacent communities. The two-part series, supported by a months-long effort to gather data from multiple federal, state and local government agencies, revealed that even though oil well operators post bonds to finance cleanups, California needs $6 billion to clean up these wells in light of the fact that just $110 million is available. Extensive mapping and data aggregation helped create a rich accessible package. The series studied the state and also specifically devoted one piece to the challenge just faced by Los Angeles where nearly 1,000 dry wells are monitored by two inspectors. Among the risk posed by these wells sitting in dense neighborhoods are the leak of noxious fumes as well as the risk that at any point the wells could prompt potentially catastrophic blowouts and explosions. It is a rare urban problem for Los Angeles and one that in this investigation produced mechanisms for residents of the sprawling metropolis to learn whether they live near risky wells. Regulators forced one oil company to plug a well that was the subject of the series' reporting and public officials are pushing for more stringent regulations as a result of the series."

How do we do it?

The project generates reality-based estimates and analysis of oil and gas cleanup liabilities and develops strategies to enforce accountability and show investors the true risks to the environment and their financial portfolios.

The project also provides research to public interest researchers, regulators and journalists to support consequential accountability journalism that weakens the industry and ensures that polluters pay.

Through this process, the project aims to shine a light on the full extent to which the fossil fuel industry’s business fundamentals have deteriorated in order to dramatically accelerate investment in clean energy technologies.

a systems approach

through a de-centralized network

not a public facing entity

driving current investigative journalism, state and BLM regulatory rule making, and novel litigation

We Have Reached the White House

President Biden Quotes Our Work

July 28, 2021

Remarks by President Biden on the Importance of American Manufacturing:

“You may have heard that, in Washington — and I was just on the phone — it looks like we reached a bipartisan agreement on infrastructure — a fancy word for bridges, roads — (applause) — transit systems, high-speed Internet, clean drinking water, cleaning up and caffing [sic] — cappig the orphan wells, over thousands of them abandoned, …”

“And guess what? A lot of those abandoned wells are leaking methane. And guess what? The same union guys that dug those wells, they can make the same union wage capping those wells. (Applause.)”

“For example, towns in the southwestern part of this state can now apply for funds to cap those wells that are leaking methane, clean up abandoned coal mines, invest in bringing new employers into abandoned factories, and get help attracting them.”

So we continue to say . . . “watch this” to the naysayers and climate deniers.

Research in action:

Report: Troubled Oil and Gas Companies Pay Execs $200M, Leave Taxpayers on the Hook for Cleanup Costs | Public Citizen | August 12, 2021

‘Abolish these companies, get rid of them’: what would it take to break up big oil? | The Guardian | August 11, 2021

‘Game changer’? Deal on orphaned wells sparks debate | E&E Daily | August 9, 2021

Reduce the Methane or Face Climate Catastrophe, Scientists Warn | The Guardian | August 6, 2021

Louisiana needs sand to rebuild its coast. Old oil and gas pipelines are blocking the way | Washington Post | August 5, 2021

Growing problems with orphaned, abandoned wells challenges oil industry | S&P Global | July 9, 2021

Plugging abandoned oil and gas wells could help save the environment – and jobs | CBS News | June 29, 2021

Bankers and Investors Finding Fracking Industry's Underlying Models Prove Overly Optimistic | DeSmog | Jul 17, 2020

Fracking Firms Fail, Rewarding Executives and Raising Climate Fears | The New York Times | Jul 12, 2020 (the ARO Working Group is Carbon Tracker’s North America Data Strategy Consultant)

Can There Be a Green and Just Economic Recovery From the Pandemic? | Audubon | Summer 2020

Fracking: From Revolution to Money Pit | Bloomberg | Jul 2, 2020

Support grows for taxpayer-funded oil well cleanup as an economic stimulus | Energy News Network | Jun 23, 2020

Should feds plug 'orphan' wells? States offer a warning | E&E News | Jun 22, 2020

Colorado oil company's bankruptcy liquidation to result in state taking over orphaned wells | Denver Business Journal | Jun 19, 2020

Footing the bill: The price to plug oil and gas wells goes up as the industry goes down | Boulder Weekly | Jun 18, 2020

It’s Closing Time: The Huge Bill to Abandon Oilfields Comes Early | Carbon Tracker Initiative | Jun 18, 2020

Big Oil’s Multi-Billion-Dollar Blind Spot | Drilled Podcast | Jun 17, 2020

California Gives New Meaning to Stripper Wells | Carbon Tracker Initiative | Apr 20, 2020

Could COVID-19 Spell the End of the Fracking Industry as We Know It? | Truthout | Mar 30, 2020

Will Pandemic Relief Become a Petroleum Industry Slush Fund? | Drilled News | Mar 26, 2020

Deserted oil wells haunt Los Angeles with toxic fumes and enormous cleanup costs | LA Times | Mar 6, 2020

The Flip Side: Stranded Assets and Stranded Liabilities | Carbon Tracker Initiative | Feb 19, 2020

The toxic legacy of old oil wells: California’s multibillion-dollar problem | LA Times | Feb 6, 2020

Canada’s oil bust has left thousands of abandoned wells, and not enough money for cleanup | Washington Post | Feb 6, 2020

Cleaning up after Ohio’s oil and gas industry brings a growing price tag | Energy News Network | Jan 15, 2020

Canada Pension Plan’s ongoing investments in fossil fuels: a moral and ecological failure and financial risk | Corporate Mapping Project | Nov 19, 2019

Will the Public End up Paying to Clean up the Fracking Boom? | DeSmog | Oct 8, 2019

Financial Risks of Oil and Gas Assets (A letter to the CalSTRS Investment Committee) | Fossil Free California | Sept 13, 2019

Idle Wells are a Major Risk | FracTracker Alliance | Apr 3, 2019

Literally Millions of Failing, Abandoned Wells | FracTracker Alliance | Mar 29, 2019

Saudi America: The Truth About Fracking and How It’s Changing the World | Columbia Global Reports | Sept 12, 2018

Environmentally Insolvent: Fair Value Measurement of Environmental Liabilities Poses Solvency Risk | Business Law Today | Aug 2008

On the Blog